How to Accurately Predict a Rental Property’s Cash Flow

By Mariia Kislitsyna Updated on February 17, 2022

One of the great advantages of rental properties over stocks is that investors can predict returns.

Not in a vague, over-the-next-ten-years sense. But in an immediate, this-is-how-much-I’ll-earn-this-year sense.

Calculating rental cash flow is simple and straightforward, yet most new real estate investors still get it wrong. Here’s exactly how to predict a rental property’s cash flow, so you can avoid ever making a bad investment again.

Why Rental Income Is Predictable

How can landlords predict returns on rental properties? After all, housing values fluctuate, right?

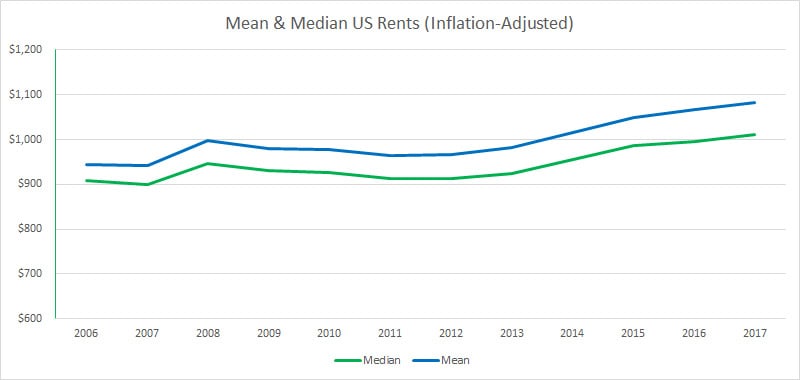

Yes, housing values fluctuate, but rents prove far more stable. Even during the Great Recession, the furthest that median US rents fell was from $947 in 2008 to $912 in 2011 – a measly $36.

Source: US Census Bureau ACS Data

Expenses do fluctuate month to month, but even they are predictable as a long-term average. For example, vacancies don’t hit landlords every year, but when they do they’re expensive. So, landlords can look at the average vacancy rate in a neighborhood, to budget a small amount every month toward the inevitable future vacancy.

Forecasting Rental Property Expenses

Where so many new rental investors run astray is confusing typical expenses with average expenses.

In a typical month, landlords have no expenses beyond the mortgage. But occasionally they get hit with large, irregular expenses, like vacancies or repairs.

The trick is to accurately forecast the long-term average of these expenses, to budget for them every month – regardless of whether you actually incur them that month.

Maintenance

Maintenance includes repainting between tenancies, replacing carpets or flooring, fixing leaks, and other minor upkeep around the property. In other words, quick fixes that are necessary but don’t dramatically overhaul the property.

Common Cost: 5% of rent.

Repairs & CapEx

Unlike maintenance, major repairs and capital expenditures (CapEx) extend the usable lifespan of the building.

For example, replacing the roof or furnace are capital expenditures. Patching a roof leak or servicing the furnace falls under maintenance.

Common Cost: 8% of rent.

Vacancy Rate

All rental properties, no matter how hot the local rental market, suffer vacancies.

If the unit turns over every year, and spends one month of the year vacant as the landlord repaints, advertises, shows the property, and screens applicants, that would constitute an 8% vacancy rate. Fortunately, most units don’t turn over every single year. In an average market, a property may see two or three turnovers in a five-year period; less if you’re lucky.

Common Cost: 4-6% of rent.

Property Management Costs

All the time, I hear new investors object: “But I’m planning on managing the rental property myself! Why should I include property management costs in my cash flow calculations?!”

For several reasons. First, you never know when you’ll need to hand your rentals over to a property manager. You might get too busy to manage the rentals properly, or you may have a health crisis, or you may just plain hate managing rentals.

Second, managing properties is work. It’s a labor expense, whether you’re doing the labor or someone else is. If you don’t budget for that labor expense, how can you compare rental returns to a truly passive investment, like a mutual fund?

As a final thought, be sure to budget both for ongoing rent collection fees and new tenant placement fees (often half or a full month’s rent).

Common Cost: 10-15% of rent.

Property Taxes

If your mortgage escrows for property taxes, they’ll be rolled into your monthly mortgage payment.

Regardless, make sure you include taxes in your rental income calculations.

Common Cost: 5-12% of rent.

Landlord Insurance

Likewise, landlord insurance may be escrowed and included in your mortgage payment – or it may not. Budget for it either way.

Common Cost: 4-8% of rent.

Accounting, Administrative, Travel, Miscellaneous

Owning rental properties will complicate your taxes. If you hire an accountant, you’ll need to pay them more for the extra work. If you do your taxes yourself, prepare for extra work.

Similarly, there is some monthly bookkeeping work involved, in recording and tracking rent payments and expenses. And if you self-manage, you will occasionally need to visit your rental properties for inspections, showings, and meeting contractors.

All of these expenses add up, and don’t disappear simply because you ignore them when you’re running numbers in a rental property calculator.

Common Cost: 2-4% of rent.

Estimating Market Rents

Just as you need to accurately forecast your expenses as a landlord, you also need to know the market rent before buying a property.

Online tools such as Rentberry help you find nearby comparable properties (comps), to get a sense for what other local rental units are going for. But to truly get a sense of market rents, you need to spend time in the neighborhood yourself.

Start by walking the streets. Learn which parts of the neighborhood are more desirable than others, and why. If rents are $200 higher two streets over, you should know exactly why renters will pay more there.

Attend as many open houses in the neighborhood as you can. Put yourself in the shoes of local renters: What amenities do they expect? What amenities are considered luxuries? How does having (or not having) any of these amenities impact rents?

Develop a gut-level feel for what rental units are going for in this neighborhood.

Not only will you know how much you can expect in rent for a prospective property, but you’ll also know what upgrades you can make to raise your rents.

Example Rental Income Calculation

Lana Landlord considers buying a new rental property. After thoroughly evaluating the property and the neighborhood, she’s confident she can charge $2,000 in monthly rent for the property.

For maintenance, Lana sets aside 5% of the rent, or $100/month. She sets aside another 8% for repairs and CapEx, or $160/month.

The local vacancy rate is 3-4%, so Lana estimates on the high side at 4%, or $80/month.

Surveying other local landlords, Lana finds a well-reviewed property management company that charges 8% of collected rents, plus a month’s rent for each new tenant placed. To be conservative, Lana sets aside 12% for property management costs, or $240/month.

She looks up the property tax records and confirms the annual property taxes are $3,000, or $250 per month. After talking to her insurance agent, she estimates the annual insurance premium at $2,000, or $167/month.

Finally, she adds 3% for administrative, accounting, travel, and other miscellaneous expenses. That comes to $60/month.

Her total monthly expenses for the property come to $1,057/month, leaving $943/month in cash flow, not including a mortgage.

To run the numbers instantaneously, use a rental income calculator (we offer a free one at SparkRental).

The 50% Rule

Just running quick numbers in your head?

An instant shorthand you can use is the 50% Rule, which holds that rental property expenses usually fall at around 50% of the rent. It’s not nearly as accurate as actually researching the neighborhood vacancy rate, getting a quote from an insurance agent, looking up the property’s tax bill, and so on – but it’s a lot faster when you’re reviewing dozens of properties in a preliminary search.

Return on Investment

Should Lana buy that property, with the $2,000/month rent?

It depends on the purchase price, of course.

If she nets $943/month, then her annual net operating income is $11,316. At a price of $100,000, her total return would be 11.32% (not including financing, closing costs, or appreciation, to keep the math simple). At a price of $150,000, her total return would be 7.54%, and at $200,000 it would be 5.66%.

Of course, she may not buy the property in cash. By way of example, say the purchase price is $150,000, and Lana borrows 80% of it, putting down the other $30,000 with her own cash. The lender charges her 6% interest for a 30-year loan, which means a monthly payment of $719. That reduces her monthly cash flow from $943 to $224.

In other words, Lana invests $30,000 of her own money, and in return earns $224/month, or $2,688 annually. Her cash-on-cash return, therefore, is 8.96%: higher than if she had bought the property in cash.

Final Word

Real estate investing is a numbers game. If you can learn how to accurately predict cash flow using a rental income calculator, you never have to worry about making a bad investment again.

Sure, you will occasionally have a $2,500 furnace bill, or a vacancy when you have to cover the mortgage for the month or two.

But if you set aside money every month for expenses, you’ll have plenty of money in your expense account when those irregular expenses rear their ugly head.

Learn how to forecast rental expenses to stop guessing and start knowing your future returns.

About the Author:

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental.com. Among other free landlord tools, SparkRental offers free video courses to help you learn rental investing and property management, plus resources such as a free rental application and state-specific lease agreements.

Brian spends most of the year traveling abroad, and his goal is to help others replace their 9-5 income with rental income.

Mariia Kislitsyna

Mariia serves as editor-in-chief and writer for the Rentberry and Landlord Tips blogs. She covers topics such as landlord-tenant laws, tips and advice for renters, investment opportunities in various cities, and more. She holds a master’s degree in strategic management, and you can find her articles in such publications as Yahoo! Finance, Forbes, Benzinga, and RealEstateAgent.